Tesla is no longer cool.

It’s hard to find a good stock to feel safe shorting. It’s even harder in a market where Donald Trump moves the market several percent a date

Tesla reported earnings this week. It was expected to be a bad quarter—and somehow, they outdid themselves. Revenue was down 21% from a year earlier, and net income dropped 71%. Tesla reported earnings of 27 cents per share, well below analysts’ expectations of 41 cents.

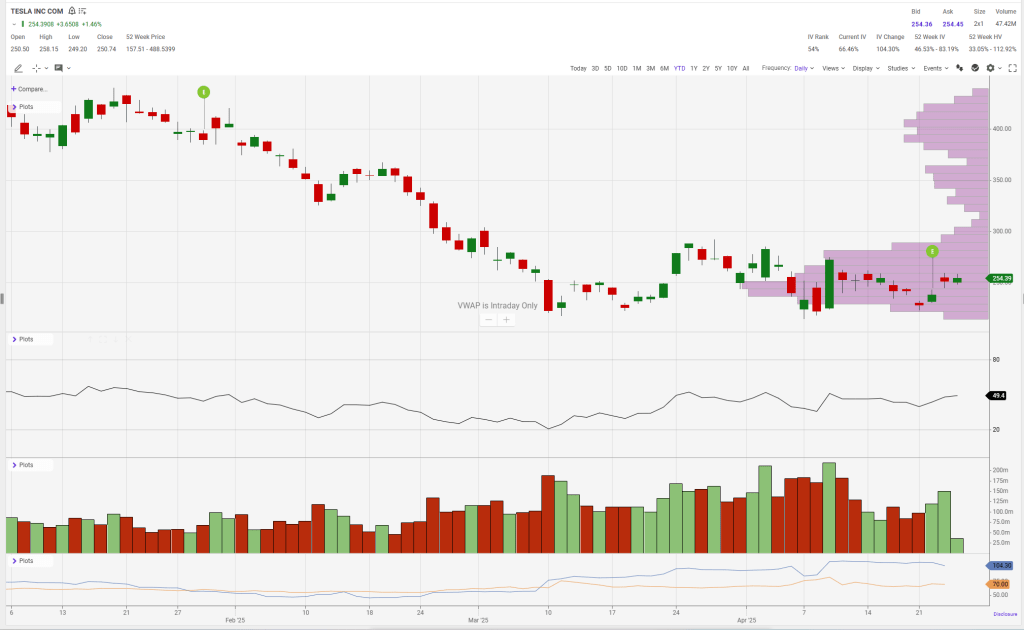

Ahead of earnings, the stock reflected this volatility. Year to date, Tesla shares are down heavily. The stock has been hit especially hard by political pressure tied to Elon Musk’s involvement with DOGE—the idiotic attempt to improve government efficiency by indiscriminately slashing federal jobs. Look, if Elon didn’t want to be punished for doing something dumb, he shouldn’t be so hell-bent on doing something dumb.

I wasn’t short ahead of Tesla’s earnings, but I entered a short position yesterday after the stock rallied 8%. We saw a reverse “buy the rumor, sell the news” situation. Tesla’s stock was sold off ahead of earnings. But after the numbers came out, the stock rallied on three factors:

- It had already been sold hard leading up to earnings

- Elon Musk would supposedly have a diminished role at DOGE

- New vehicles would increase its product line

Let me ask you a basic question: is Tesla a better company today now than it was 12 months ago?

One year ago, Tesla’s share price was $162. Today, it’s at $254—a 56% increase over the past year. However, I believe there’s a fundamental issue with Tesla as a company.

Previously, a key component of Tesla’s share price was driven by retail investors’ admiration for Elon Musk. Tesla’s core car buyers tend to lean left and supported Musk’s mission of environmental activism. But now, those same buyers are not just indifferent toward Musk—they actively dislike him. What was cool last year is now actively uncool.

After Tesla rallied yesterday, I concluded that, relative to its peers, it’s a strong candidate for a short. But I wanted a short that could withstand adverse price moves without triggering a liquidation. That meant no leverage and a long enough time horizon.

I wanted a position I’d feel comfortable holding for several months. I felt very comfortable shorting TSLA stock by buying long-dated put options. I recommend buying puts that expire one to two years out and selling short-dated, out-of-the-money puts against them. Here’s the trade:

Buy: At-the-money 2027 puts on TSLA.

Sell: Short-dated, out-of-the-money puts as a premium recapture component.

Leave a comment