I’m one of the few users in the world who has actually used MicroStrategy’s software. Granted, it was about 10 years ago when I was just an investment analyst, but I know how effective the software is. Back then, it was an excellent platform for managing large datasets. I’m not sure how it compares today, since I’m no longer in an analyst role, but a quick Reddit search suggests it has been quickly outstripped by other data platforms like Power BI.

Today is February 18, 2025, and MSTR is trading at around $332. At that valuation, the estimated market cap is just shy of $86 billion. Quarterly revenue from its business is approximately $120 million, putting annualized revenue at around $500 million. This results in a price-to-revenue ratio of about 172, which is quite expensive for a mature company. However, this also indicates that MSTR’s valuation does not stem from its core business. Instead, MSTR derives its value from its Bitcoin holdings.

Michael Saylor, the CEO of MicroStrategy, announced yesterday that MSTR owns 478,740 Bitcoin, valued at $31.1 billion (see below). Given that MSTR’s market cap is approximately $86 billion, this implies that the company’s Bitcoin holdings are worth about 2.5 times less than its market cap.

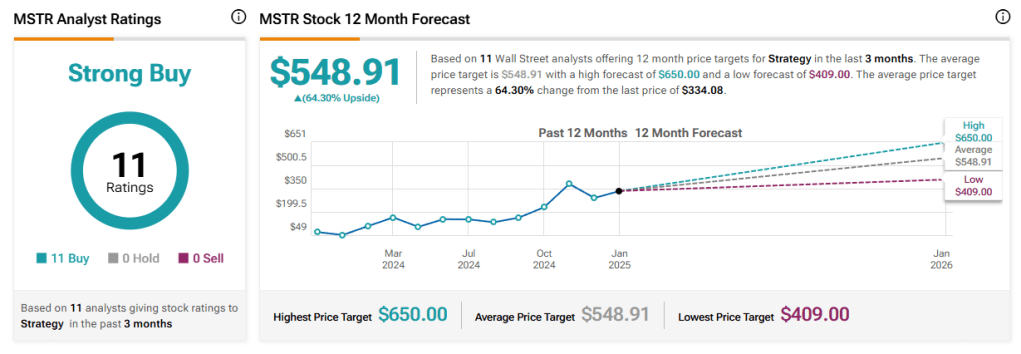

What surprises me, then, is the sheer bullishness of analysts on MSTR. They know these facts better than I do, as they are directly involved in assigning a valuation to the firm. They are fully aware that MicroStrategy’s valuation is fundamentally tied to its Bitcoin holdings. So why are the analysts so bullish?

The easy and likely correct answer is that they have stopped being equity analysts and have shifted gears into commodity analysts. MSTR has entered into a plan to sell equity and debt to acquire over $40 billion in Bitcoin. But in the real world of corporate finance, selling debt and equity does not increase market value—it is a wash transaction, assuming no fees associated with selling. So that plan to acquire Bitcoin does not hold up to corporate finance principles. But that’s irrelevant; in today’s world, corporate finance means nothing for meme stocks.

So, the analysts have become commodity analysts because they are making assumptions about the valuation of Bitcoin. They believe Bitcoin will be worth more in the future. I’ve worked in the oil and energy field for years, and I can tell you there are individuals who have lost their firms because they thought natural gas prices would only go up—or that oil prices would only go up.

Bitcoin may be different—it may only go up. But assigning positive value to a firm based on inherently flawed assumptions is just lazy analysis. MSTR is wildly overvalued today based on the value of its holdings. Don’t assume otherwise.

Leave a comment