Let’s wind the clock back to 2021. Winter Storm Uri hit in February, slamming the middle of the U.S. (and no, I refuse to call Ohio a Midwestern state) and Texas as well. The cold was so intense in Texas that the pipes supplying fuel to generators froze. ERCOT decided to send all electricity prices to the maximums for hours at a time, bankrupting civilians, generators, and resellers alike. It was quite the spectacle—if you didn’t care about the human impact. It was also one of the first instances in modern history where we saw electricity fail due to a mix of human politics and natural disasters.

There were subsequent winter blasts in 2022, one in February and another in December. Both caused wild price spikes in ERCOT and MISO, but the grid held up relatively well. Sure, prices surged, but consumers were more insulated since fewer were on variable rate plans tied to real-time prices. However, it left a hangover effect among nodal traders, leading many to chase those gains in the aftermath.

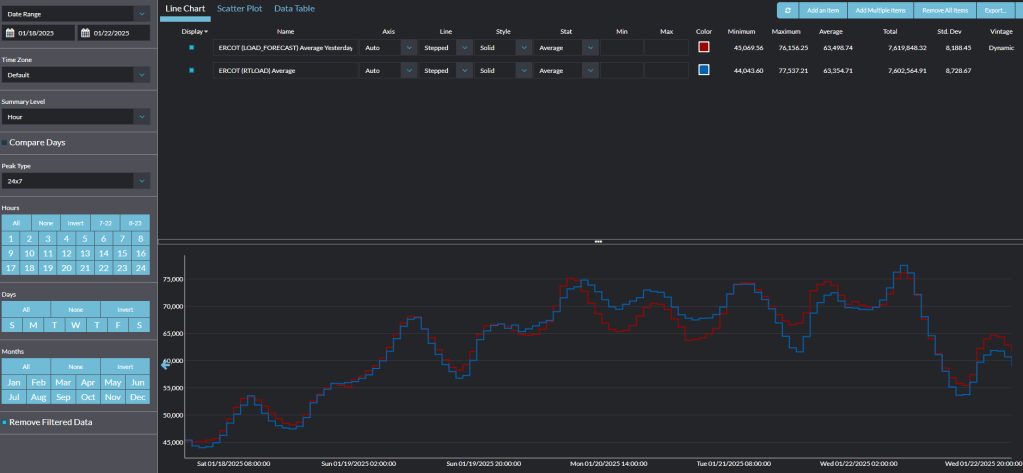

First, let’s look at the ERCOT load forecasts. The red line below represents the load forecast as of one day prior, taken at 8 a.m. Central Time. The blue line represents the actual load values.

There are a couple of interesting nuances here. One is that the load forecasts were inaccurate for the 20th and 21st, at least to some degree. The actual load came in higher than forecasted, and when that happens, real-time prices are typically higher than day-ahead prices. As a reminder, electricity is traded across multiple time frames, but I focus primarily on the day-ahead market. For more details, click on this link.

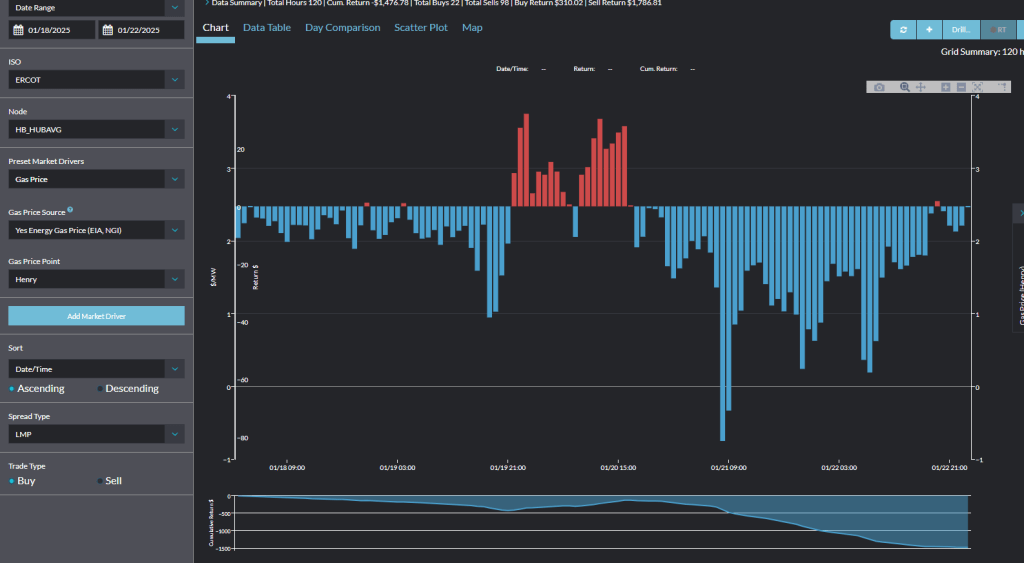

So what did prices do in ERCOT?

I added a graph above that now includes the Hub average return in ERCOT. ERCOT wasn’t ugly, but it wasn’t exactly pretty either. The winter storm started around January 19, 2025, and we saw some positive returns on January 19 and 20. But as the storm really hit its stride, much stronger losses began to appear. In fact, the below graph shows the actual returns for HubAverage for the same days as above.

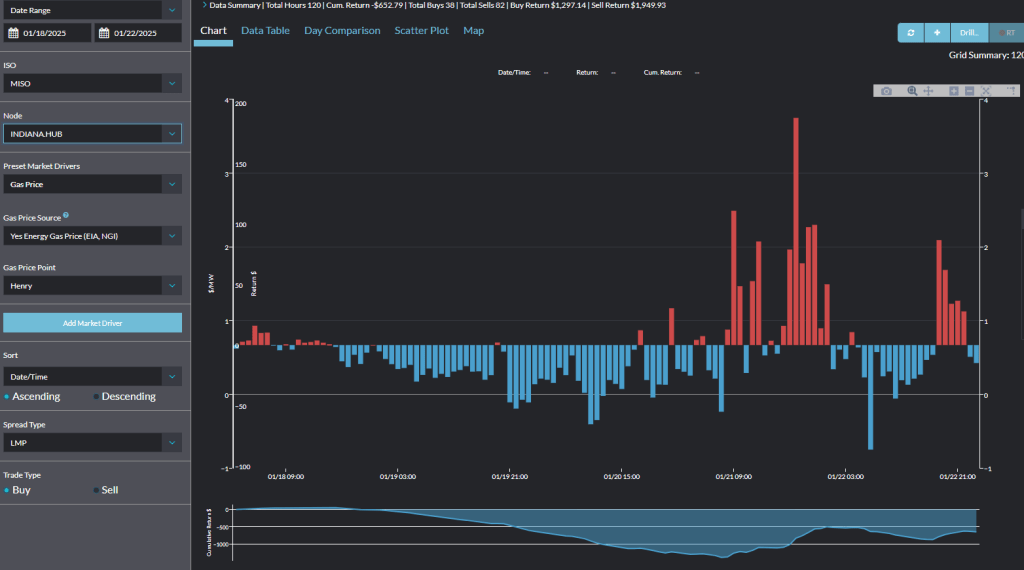

So what about MISO? Well, the story is largely the same. See below for one of MISO’s largest hubs, IndianaHub’s returns.

So what gives? What happened? The answer is straightforward: overpaying for generation. The elevated day-ahead prices in the virtual market influenced the generation dispatched for the following day. Due to the high day-ahead prices, there was an abundance of excess generation available. As a result, this winter storm didn’t create the kind of price fireworks some might have expected. Many long players lost money, although some likely made profits if they targeted the right hours.

Leave a comment