My, my, my, what a difference 2.7% makes. That’s the margin between Novo Nordisk’s target of 25% weight loss for their experimental drug, CagriSema, and the actual numbers produced on a trial basis. CagriSema’s average impact on the human body was 22.3%, which is still excellent but not as good as previously forecast. Worse, Eli Lilly’s Zepbound has a higher weight loss average of 22.5%, which, while not significantly more than Novo Nordisk’s experimental drug, is still enough to claim an edge.

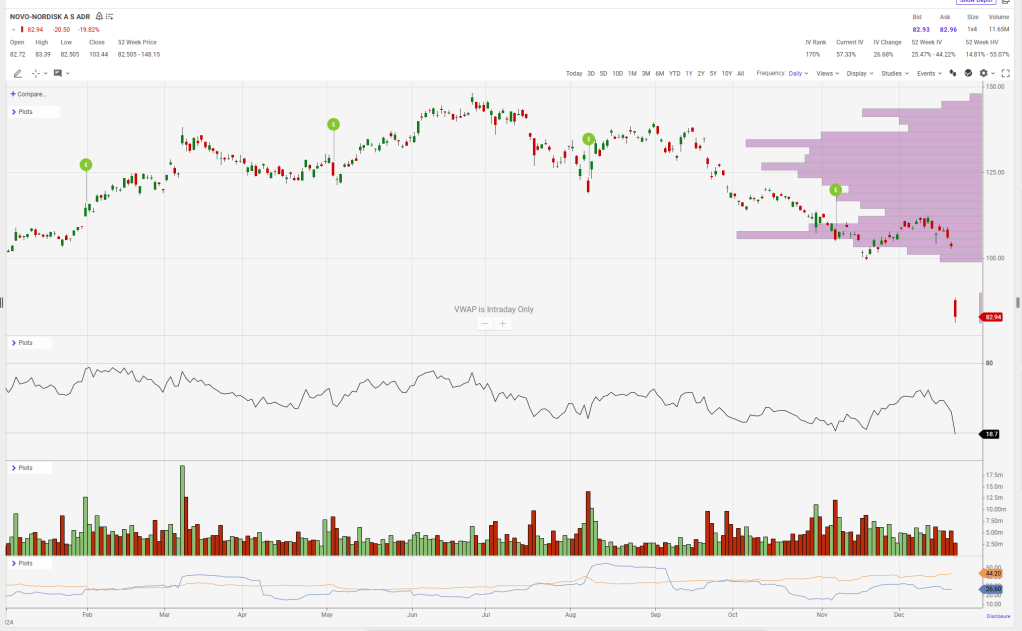

In European trading, the stock had lost 29% before paring some of its losses. It’s currently down 20% as I’m writing this article, but who knows what will happen as the stock market continues through today. More importantly, the stock is down over the last year as the hype around weight loss drugs begins to fade, and more realistic investor expectations take hold.

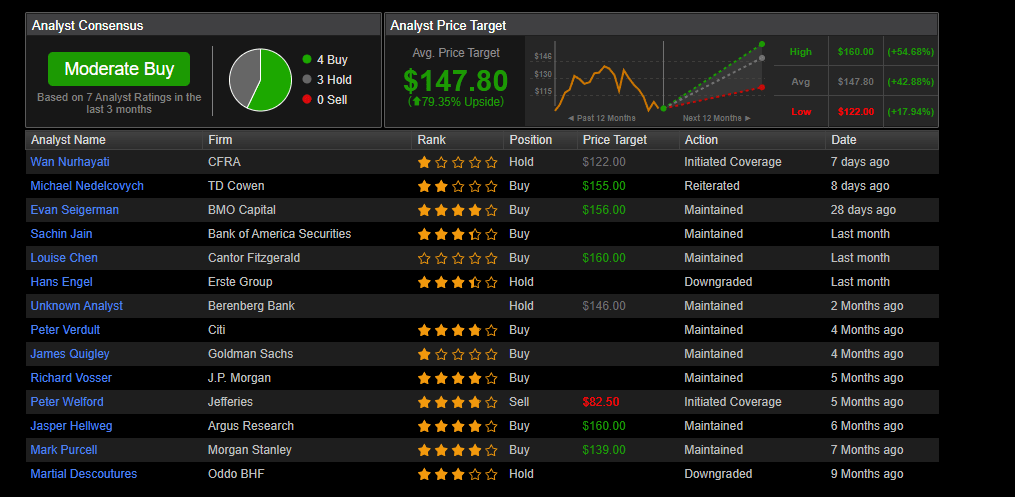

From an analyst perspective, prior to today, the stock was expected to return somewhere in the neighborhood of 70%. The news has not yet been fully digested, and analysts tend to wait until the dust settles before offering revised price targets. Still, I like to include them because they’re interesting and provide feedback on the health of a company, if nothing else.

But the thing about Novo Nordisk is that it has strong brand power through the name Ozempic, and it will continue to maintain those high levels of recognition. Novo’s drug isn’t as effective as hoped but is still highly effective. Doctors strongly believe in the power of these drugs to improve overall health, so the market will continue to grow. Heavy competition has diluted the hyped expectations of earlier times, but these drugs will remain consistent money-makers.

Novo Nordisk was a neutral buy at $100 but now represents strong returns on invested cash. The firm earns at least $3.5 billion per quarter, which gives it a PE ratio of roughly 25–30 at current valuations. That makes it a reasonable buying opportunity in a steady, consistent, and growing market.

Don’t use options, buy shares.

Leave a comment