Something interesting happened to AMD today. In the premarket, it was up 0.3%, which is within the margin of premarket trading that doesn’t surprise anyone. Then, out of nowhere, it just collapsed.

As I’m writing this post, AMD is down about 3.5%. There’s no immediate reason for AMD to be down this much. Earlier this week, AMD was downgraded by Bank of America, with a new price target of $155, down from $180. That’s about the extent of the news, and both AMD and Nvidia have been under pressure.

Of course, there’s also the news that China is considering banning exports from Nvidia, and that can’t be discounted. Perhaps the market selloff is a combination of that news and the downgrade. Or maybe it’s purely a technical selloff, with some asset holders taking profits or cutting losses.

In any case, AMD has shed nearly $20 in value over the past 10 days, dropping from around $143 to $126. That’s a significant loss of shareholder value in just two weeks, and there doesn’t seem to be an obvious catalyst behind it.

I was skeptical of AMD’s fundamental value after the crypto-mining collapse that followed Ethereum’s shift to proof-of-stake. At the time, there was a serious risk that the mass purchase of mining equipment was just a temporary demand spike. However, AI is here to stay. There’s no doubt in my mind that as companies work to figure out how to monetize AI, they will spend large quantities of cash buying the “shovels.”

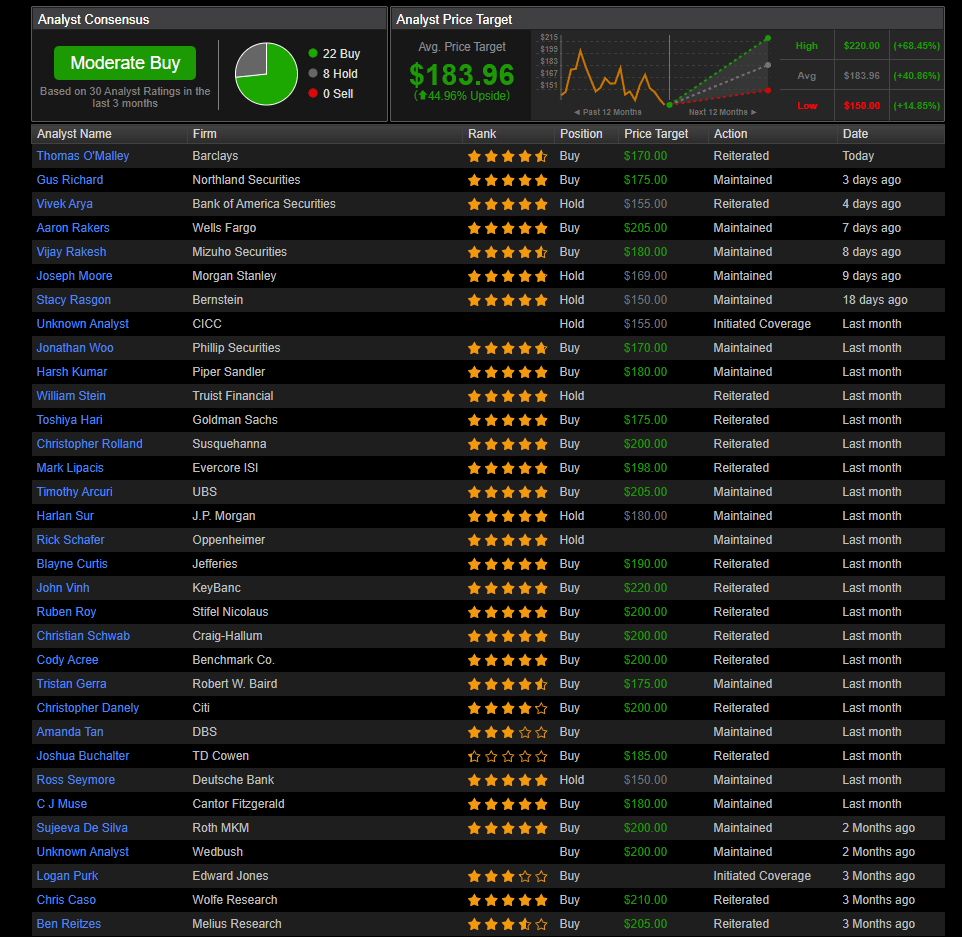

I’m not alone in my thoughts. Looking at the Wall Street analyst rankings (though one should be skeptical, as analysts often exhibit herd behavior), there is strong institutional support behind AMD. Currently, there are 22 buy ratings and 8 hold ratings. Notably, there are zero sell ratings at this time, and the lowest 1-year price target for AMD is $150.

Of course, the situation could change. AMD’s chips could become obsolete, AI could kill us all, or China could decide to stop supplying the gallium needed to create these chips. But stocks are always continuously pricing in the risks associated with making money. If these risks are significant enough to keep you on the sidelines, so be it. For me, however, the risks are known and measurable, and the negative value of these risks does not outweigh the massive profits associated with chip production today and in the future.

Leave a comment