I understand the optics of discussing anything political just weeks before an election can be toxic. Donald Trump’s influence on his stock, DJT, makes it a compelling trade in either direction. If you’re bullish on Republicans, you’re likely bullish on DJT. If you’re bearish on Republicans, you’re likely bearish on DJT. That’s about as far as I’ll go into the background here; the goal is to focus on money, not politics.

I couldn’t find any analyst ratings for DJT stock either, which is surprising and makes it challenging to assess a proper valuation for the firm. While we can rely on traditional metrics like revenue or market cap, these become less useful when there’s an external influence, such as political factors, heavily impacting the stock’s performance.

Rather, I’m going to make an assumption that DJT is overvalued based on Twitter’s valuation of $12.5 billion. That’s about as far as my assumptions take me. DJT’s appropriate valuation is some multiple lower than Twitter.

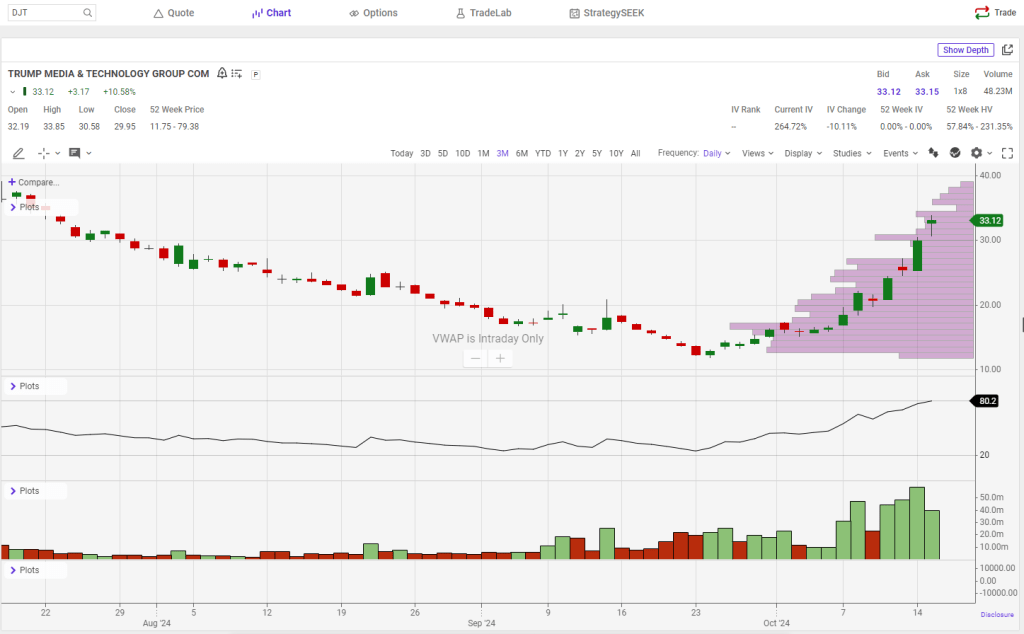

With those assumptions, the goal is to trade DJT. The three-month performance of DJT is telling. It saw a low of $11.75, a high just shy of $40.00, and is currently trading at $33.12. DJT’s short-term fortunes are inextricably linked to two key factors

- The outcome of the election

- If Donald Trump sells a substantial portion of his shares

I will make no assumption on item 1. Whatever happens happens.

I am making an assumption that there will be selling pressure from insiders over the next year for item 2, regardless of the election outcome. I want to short DJT shares but not pay the high borrow fee or have exposure to short-covering. I want my risk exposure to irrationally reduced.

The obvious solution is puts. DJT’s current IV is sitting north of 240%, so there’s a lot of volatility baked into the price. The puts aren’t cheap. To buy a 30P expiring in Jan 2027, you’re looking at paying about 60% of notional value.

Even with the high expense of the puts, it makes sense in this case. DJT appears overvalued and will likely face internal selling pressure within the next 12 months. The broader market is frothy, making it tough to find clear opportunities for buying or selling value stocks, but DJT stands out. It recently dropped to $12 within the last three months, and while its price may be influenced by the election, irrationality can’t persist forever. At some point, the fundamentals will have to align with reality. The potential for a reversion to fair value makes the high-cost puts a more justifiable play.

To pay for the puts, it’s profitable in the short term to sell options against it. I recommend going long 30-strike puts expiring in January 2026 or 2027, and then selling sub-10 puts against it 3 weeks out or more.

Leave a comment