Let’s start with the link and the post:

We’re looking at Schrödinger’s options explanation: the user is somehow both correct and incorrect. It’s important to delve into what implied volatility (IV) is and how it affects all options, not just those that are far out-of-the-money (OTM).

There are several factors that go into option pricing. The main components, as defined by the Black-Scholes model, are:

- Delta

- Vega

- Theta

- Rho

- Strike

Let’s focus on item 2: Vega, which represents volatility. Vega measures an asset’s tendency to move in the future, reflecting the market’s expectations of how much the asset’s price will fluctuate. While volatility calculations are often based on historical price movements, volatility itself is inherently forward-looking.

Unlike stock prices, which reflect both present value (like cash, assets, or debt) and future potential, volatility is concerned solely with expected future movements. It doesn’t care about the current state of the asset—just how much it might move going forward. Thus, we end up with “implied volatility” or an expected measure of how much the asset will move in the future.

A key component is: if there is more uncertainty then there is more implied volatility.

The biggest driver of uncertainty in the ordinary course of publicly traded firms is the release of their earnings. After a company releases its earnings, the stock can move aggressively in any direction. All options start pricing in this increase in volatility prior to the earnings release. The strike of the option is almost inconsequential. All strikes will experience increased uncertainty, and thus the implied volatility for the entire options chain increases.

After the earnings are released, the information becomes known. As the information is absorbed by the market, the future becomes clearer. Under most circumstances, implied volatility (IV) will drop after an earnings event, with few exceptions—such as in going concern situations.

Thus, another conclusion is that IV serves as a proxy for uncertainty.

IV crush is the result of information becoming known. Ironically, short-dated options have less known information than long-dated options. In the short term, you don’t know if the company will meet expectations. However, in the long term, you can generally sense if a company is solid or not.

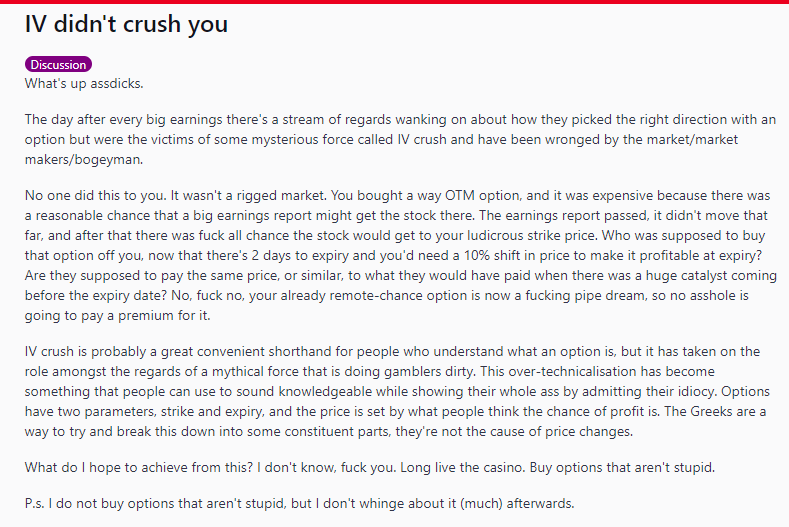

Reference in case the user deletes the post

Leave a comment