It’s 4:17 pm Central Time, and United Airlines just dropped their latest earnings report 77 minutes ago. How was it? Well, it wasn’t overwhelming. It wasn’t underwhelming. It was just whelming.

United posted an adjusted Q2 EPS of $4.14, beating the $3.95 estimate. So, that’s good, right? But wait, there’s a catch—they had about $100 million less in revenue. And if you’re looking ahead to Q3, brace yourself for more meh: their EPS guidance is now in the $2.75-$3.25 range, compared to the original industry estimate of $3.43. So, yeah, just whelming. Oh, and for the full year? The EPS estimate for 2024 is now somewhere in the $9-$11 range, which is pretty wide.

The stock showed classic earnings behavior. It jumped up about 2.5% immediately after the earnings posted, but then dropped 5.5% about three minutes later. Seventy-seven minutes later, the stock is completely flat from its close. There’s no change whatsoever. In economic parlance, that’s known as price discovery. I think it’s more accurately known as “nobody knows what to price the stock.”

Now, here’s the thing about airline stocks: they’re fascinating. Take Spirit, for example. It’s flirting with bankruptcy after a failed acquisition by JetBlue. Airlines are capital-dependent and incredibly cyclical businesses, so the risks are appropriately priced. Yet, when you look at the strong performers, they’re making money hand over fist.

And United is high-flying—literally and figuratively. Two days ago, United was trading at $44.20. With an average EPS of $10 for FY 2024, that’s a PE ratio of just 4.4. The updated PE ratio for 2024 is now closer to 4.7, but that’s still very strong. Their net income is growing in line with capacity, with Q2 2023 net income at $3.24 per share. That’s a remarkable growth in net income, especially considering that United operates in a very capital-intensive industry where growth is expensive.

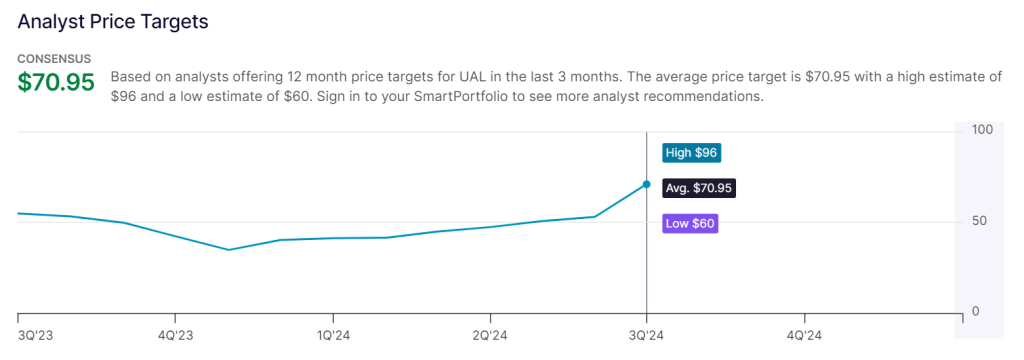

I’m not the only one to think so. The updated analyst forecasts haven’t come out after today’s earnings, but I fully expect equity analysts to feel the same way I do. Analysts are overwhelmingly bullish due to United’s ability to generate cash.

Of course, this kind of stock is not without serious risks. Airlines are prone to cyclical supply and demand cycles, event risk, credit risk, and world-blowing-up risk. Thankfully, United’s options chain isn’t that expensive.

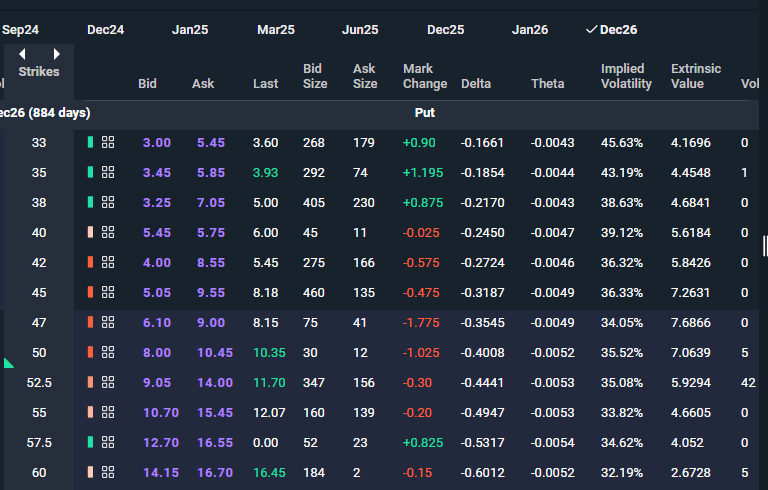

Just to recap, the stock is trading around $47.20 right now. Looking at the options chain, we see wide bid-asks because these are the last known prices, during the close right before an earnings event. The bid-asks aren’t normally this wide, but let’s assume some risk. Let’s buy at the ask.

Looking at the $47 put, we can see that it’s trading with a bid of $6.10 and an ask of $9.00. That represents a little over 25% of the strike value, so your maximum potential loss would be about 25% if you purchased the put. That’s not bad for 884 days of protection.

If I wanted to benefit, I would enter the following trade: Buy 100 shares of United stock and buy 1 December 2026 47 put. While conducting this trade, I will sell covered calls against my United stock, ideally at a strike price of 53 or higher, collecting premiums weekly. If United continues to grow at its current rate over the next year, I should benefit from price increases while also increasing the strike price at which I collect premiums.

The put would protect against event and systemic risk. United’s lowest analyst estimate is currently at $60 dollars. It seems like an obvious buy.

Leave a comment