Hint, he sold

I know it seems like I talk a lot about GameStop, relatively speaking, but it’s just so dang interesting. It’s a masterclass of optionality and influence.

Below is the GameStop call options chain expiring in 9 days (not all strikes visible)

Keith Gill, aka Roaring Kitty, owned 120,000 call options expiring on June 21, 2024, with a $20 strike price. At the close of trading today, the options had a delta of 83.64, would lose about $0.1075 per day on theta, and had approximately 170,000 open interest. As a reminder, open interest is not calculated in real time. Keep those metrics in mind; they’ll be important in a bit.

Let’s do a basic refresher on delta hedging. When an individual buys an option for speculation purposes, they are not hedging the delta of that option. Their intent is to reap the full volatility associated with owning an outright option, so there is no subsequent buying and selling of underlying assets for hedging purposes. In contrast, when a counterparty sells an option, they are likely hedging it by engaging, among other practices, in delta hedging.

Here’s the technical definition of delta hedging: “an options trading strategy that aims to reduce, or hedge, the directional risk associated with price movements in the underlying asset.“

We can apply it in practice to a single GameStop $20 call expiring June 21 2024:

- Delta on the option is 83.64. This implies that for every 1 dollar move in the underlying, the option increases by $0.8364 in value.

- Delta is not static. The more “in-the-money” an option is, the higher its delta value. That’s why the $19 call has a delta of 87.94 and the $21 call has a delta of 78.58. This is called convexity, but we won’t go into it here.

- When a speculator buys a call option, the seller of the option manages their risk by purchasing offsetting shares. In actual terms, if someone bought a GME 20C Jun 21 2024, then the seller of the option would purchase 0.8364 shares to protect against that option rising.

- As the price of the asset rises, the delta of the asset rises too, so the originator of the call would purchase more shares to hedge. It can lead to positive feedback loops

For a single option, there’s not a lot of influence on share price. There’s a very tight spread and minimal slippage on a single share. However, let’s say that you were Keith Gill, and you purchased 120,000 options in a single moment. The sellers of those options would need to purchase this many shares: (and we are making many assumptions and holding much else equal)

120,000 (options) × 100 (shares/option) × 0.8364 (delta hedge) = 10,036,800 shares

That’s 10 million shares. Roaring Kitty purchased his call options when GameStop was around $20 or so, well below its current price of over $25. The market makers selling those options hedged their positions by acquiring an eight-figure stock position just for hedging purposes. Market makers sell the option, acquire stock to hedge, stock goes up.

Which takes us to our question of the hour: did Keith Gill sell some of his options position? What do we know so far?

- There’s 170,000 open interest.

- 120,000 of the open interest is owned by Keith Gill

- That leaves 50,000 open interest not owned by Gill

- Gill owns almost 71% of the open interest on the June 21 2024, 20C

Gill literally does not have enough cash to exercise his options. He would need 12 million shares * $20 per share, or about $240 million, to buy those shares. He needed to liquidate his options position or roll them.

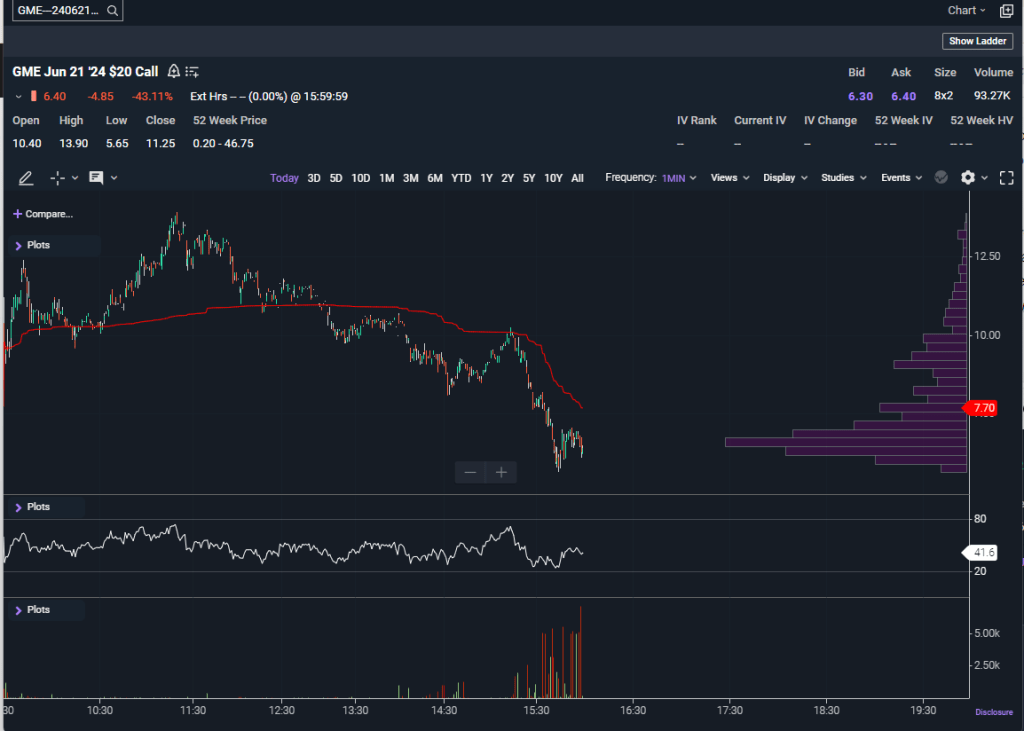

Here’s the volume chart today:

In the last 30 minutes of trading or so, somebody began selling blocks of options. The total volume of the options today is 93.3k, implying that Gill would have had to liquidate at least some of his position. We can assume that he was liquidating because the price went down as the block trades hit the market. But why am I so confident that it’s selling action, and not neutral/buy action?

As Gill was selling options, the market makers no longer needed to retain their hedges. Remember, market makers hedge via delta hedging, so they were long about 10 million shares. As some of the position gets unwound, the market makers can start closing out their own long hedges, putting pressure on the sell price.

We won’t know to what extent he liquidated until tomorrow’s open interest numbers. I’m not saying the meme train is done rolling, because Gill can easily enter into new positions with different expiries, but we did just witness something incredible in the options market. What a time to be alive.

Leave a comment