It seems that Andrew Left and I have similar concerns. I was musing to some others yesterday that I’m not exactly sure how Keith Gill, the user who sparked a legitimate short squeeze rally in GameStop in 2021, has gained so much wealth. It’s clear that others shared my concerns, such as eTrade, but we’ll get into the details.

(On a personal note: I hope that Gill does great, I really do. He seems like a genuine human being who is easy to root for. That being said, his source of funds is a legitimate concern.)

Let’s rewind to late 2020. Gill, a relatively unknown user on Reddit’s WallStreetBets, had a legitimate investment thesis that GameStop’s stock was heavily shorted and undervalued. Whether or not you agree with that thesis is a matter of debate, but Gill’s intentions were genuine. As a former employee of MassMutual, Gill was a trained financial professional who had extensive experience in valuing companies and analyzing financial statements.

Gill substantiated his thesis with concrete evidence of his position and provided regular updates on his trade, offering detailed insights into his investment strategy. The users on WallStreetBets began to rally behind Gill’s investment thesis in late 2020 and early 2021. By mid-January 2021, Gill’s initial investment of less than $60,000 had surged to nearly $8 million, representing a staggering return on investment (ROI) of over 13,000%.

Gill continued to share regular updates until April 16, 2021. By then, his investment had ballooned to a staggering fortune of at least $34 million, according to his final screenshot. GameStop’s stock was soaring, and Gill had become a legendary figure among the WallStreetBets community, he was King of the Apes. While I haven’t conducted an exhaustive search, I recall that Gill reportedly realized profits of around $50 million. However, I’m unable to verify the source of this information, and I welcome any assistance in confirming or correcting this figure.

After that, Gill went dark, and rightfully so. He had cemented his status as the Warren Buffett of the internet, achieving something truly remarkable by sticking to his investment thesis with unwavering conviction. It was time for him to reap the rewards of his success and enjoy his well-deserved winnings. Gill’s thesis had played out spectacularly, at least in the medium term, and he had secured generational wealth.

Fast-forward to May 2024. Roaring Kitty’s Twitter/X account suddenly resurfaced, posting memes that sparked a surprising rally in GameStop’s stock. Notably, the memes were unrelated to GameStop, but the account’s supposed connection to Gill was enough to fuel speculation and drive up the stock’s price. Then, on June 2nd, 2024, Gill broke his silence by posting an update on his Reddit account, revealing that he had reestablished his long position in GameStop.

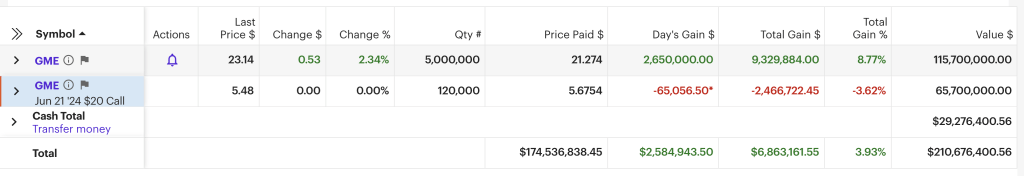

A breakdown of his position shows the following

- +5 million shares at a price paid of $21.274 a share

- +120,000 call option contracts for a June 21 expiry, 20 strike, at a cost of $5.6754

- $29,276,400.56 in cash

With a total investment of $174 million, several questions arise. The most pressing one is: how did Gill manage to transform $50 million in profits into $174 million in just three years? Here are the main issues that Andrew Left raises, and I must admit, he has identified more concerns than I initially did (my primary focus was on cash sourcing).

- Where did the money come from? Gill would have paid taxes on the $50 million profit, implying a tax liability of approximately $10-15 million, leaving him with a net amount of around $40 million.

- Andrew Left points out that there is no clear investment thesis this time around.

- The options are short-dated, which is a departure from Gill’s previous strategy that typically involved a combination of long-dated options and stocks. His current position is inconsistent with his past investment approach.

The easiest explanation is that Gill received an infusion of outside cash, which would also partially explain why eTrade is considering shutting him down. Any cash infusion of this magnitude would require eTrade to verify the funds’ origin to ensure they don’t come from illegal sources (such as terrorism or drug trafficking). While the know-your-customer component of Keith Gill’s finances would need to be reviewed, it shouldn’t be too extensive, given his reputation as an upstanding citizen. However, eTrade is concerned about potential liability if Gill’s posts were intended to manipulate GameStop’s stock price.

There are other plausible answers as well:

- Gill rode the GameStop rally on the way up, initially positing that the company could be valued at $1.5 billion. A reasonable trader might also have taken positions to capitalize on GameStop’s decline on the way down, likely using a combination of put options (rather than short stock, due to the expense factor). This is somewhat likely, but I wouldn’t bet on it.

- Gill clearly has a strong risk tolerance. It’s possible that Gill purchased long-dated call options on indexes, betting that the indexes were undervalued. In this scenario, Gill could have generated the cash simply by being long on the indexes, which seems highly possible to me.

- Gill had sold Gamestop options to take advantage of its high volatility, organically growing his cash position

Without examining the paper trail, my theories remain speculative. The concern is that Gill received a cash infusion with the intention of manipulating the market, leveraging his significant following to his advantage. In this case, I hope for the best but am preparing for the worst. Gill’s covered his tracks well; he has neither waxed poetic about Gamestop in the last 3 years nor told anyone to buy. His deniability is strong.

Leave a comment