My best friend told me to find someone who loves me almost as much as Tesla’s board loves Elon Musk.

A standard public corporation in America looks like this:

- A mix of retail and institutional shareholders own equity in a firm

- A CEO, elected through majority votes from the board of directors (BOD), heads the firm

- The CEO still reports to the board

- The BOD determines a compensation package for the CEO that they believe is fair

- At no point are shareholders truly informed of the negotiations of the compensation package… it just happens

- CEO is happy to be paid 351 times more than the average employee (in 2020)

- CEO works, doesn’t threaten to withhold technology from its firm, and lives happily ever after managing the firm until it inevitably dies or the CEO does

Of course, Tesla is not a typical public corporation in America. Its CEO is a firebrand personality who has added value to the firm through a mix of engineering expertise, driving employees to work harder to rectify his mistakes, and leveraging the public markets. Tesla was arguably the first meme stock, even before meme stocks became a phenomenon. The cult of the internet truly believed in Elon Musk’s ability to create tremendous value from stress, and they were right! If you were an early Tesla shareholder, you could have reaped the rewards and laughed all the way to the bank in your brand-new, self-driving Model 3.

But now things are different. The year is 2024, and the population has partially soured on Elon’s self-aggrandizing form of business. They are not afraid to push back, especially during legal trials where the board of Tesla has to defend Elon’s large compensation package. Shareholders will sue him and actually win, which is a nice change of pace from previous lawsuits that he seemed immune to.

Which brings us to our topic of conversation today: the large equity compensation package afforded to Elon through Tesla’s BOD. A quick recap: a Delaware court struck down a large compensation package for Elon Musk granted by Tesla’s BOD. The judge noted Musk’s “extensive ties” with members of the BOD and agreed with a shareholder that the package did not pass the sniff test. As a result, Tesla’s BOD must get approval from its shareholders for Elon’s original compensation plan.

Glass Lewis, a proxy advisory and financial services firm, argued against Tesla’s compensation package over the weekend. And why wouldn’t they? Large compensation payouts have the effect of diluting the stock. Regular shareholders get burned through non-cash equity initiatives (selling the stock gets the company cash, whereas giving it away gets the company nothing). In a standard corporation, the BOD typically comprises large shareholders who benefit from increasing share prices. Thus, the standard BOD tries to balance keeping compensation high for the CEO but low enough to avoid significant dilution. And most of the time, this balancing act isn’t an issue!

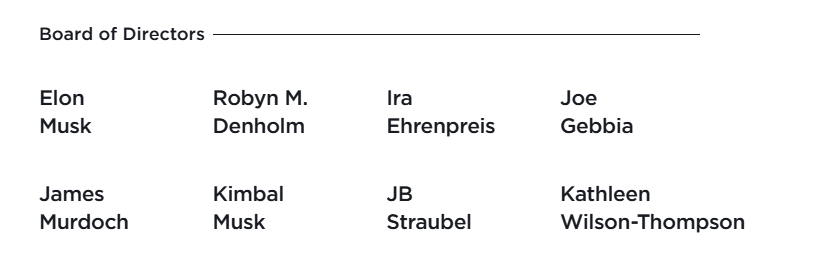

But we know that Elon is close to his board. For example, he’s on the board and so is his brother. In fact, according to a great WSJ podcast, most of the men and women on the board are buddy-buddies with him. They are failing one of the key tenets of principal-agent management: they are in too deep.

So when Elon threatens to withhold technology from his firm, the board should be trying to push back on him privately. When Glass Lewis issues a paper advising shareholders to vote against a compensation package, the board should technically agree with Glass Lewis because their role is to manage dilution and equity strength in the long run, not in the short run. There are many things the board should do, but it can’t when its dad is mad.

Which leads me to my conclusion: there’s something wrong with Tesla’s BOD and Elon’s relationship. I don’t have a solution here. There’s no magic lamp to rub to make it all better. It may require shareholders to aggressively request independent board members, but we both know that’s not going to happen with such a strong retail base. But a parent threatening its kids with not going to the movies is one thing; Elon threatening an entire shareholder base is quite another.

This is textbook abusive relationship, where one party believes it is necessary for the other’s well-being. Sometimes in those relationships, the abused party finds that they can leave, and they’ll be better for it. Life will go on. It’s time for Tesla’s board to grow up and leave the house.

Leave a comment