There are key assumptions when investing in stocks: you assume that you will earn a risk-adjusted return over a period that will be enough to compensate you for, well, the risks. Equity compensation is expensive, and it seems like no equity is more expensive right now than Nvidia. Yet, on the surface, Nvidia’s not that expensive. I’m not joking, it’s really not.

But first, we must make some key assumptions. There are more, but these come to mind immediately:

- The stock market’s risks are currently known. Within this assumption, we posit that there are no external or idiosyncratic risks other than what is currently going on with the world. There’s no global virus, rates will remain stable to moderate, there is no nuclear war on the horizon, etc.

- Artificial intelligence will continue to be a driving point of investment. Fifteen or so years ago, social media became a thing. As an economy, we didn’t truly understand the value of social media for increased sales and productivity, but companies started looking into investment and product development ideas immediately. Yet, it wouldn’t be a stretch to say that it took most firms years to really understand how to use social media to meaningfully increase sales.

Last quarter, NVDA posted an EPS of $6.12 a share. Doing a quick annualization, we get an EPS/year of roughly 25 dollars a share. As of this writing, Nvidia is trading at around $1050 a share, leading to a P/E ratio of about 42. As a comparison, the S&P 500 has a P/E ratio of around 26. Apple (AAPL) has a P/E ratio of about 29.

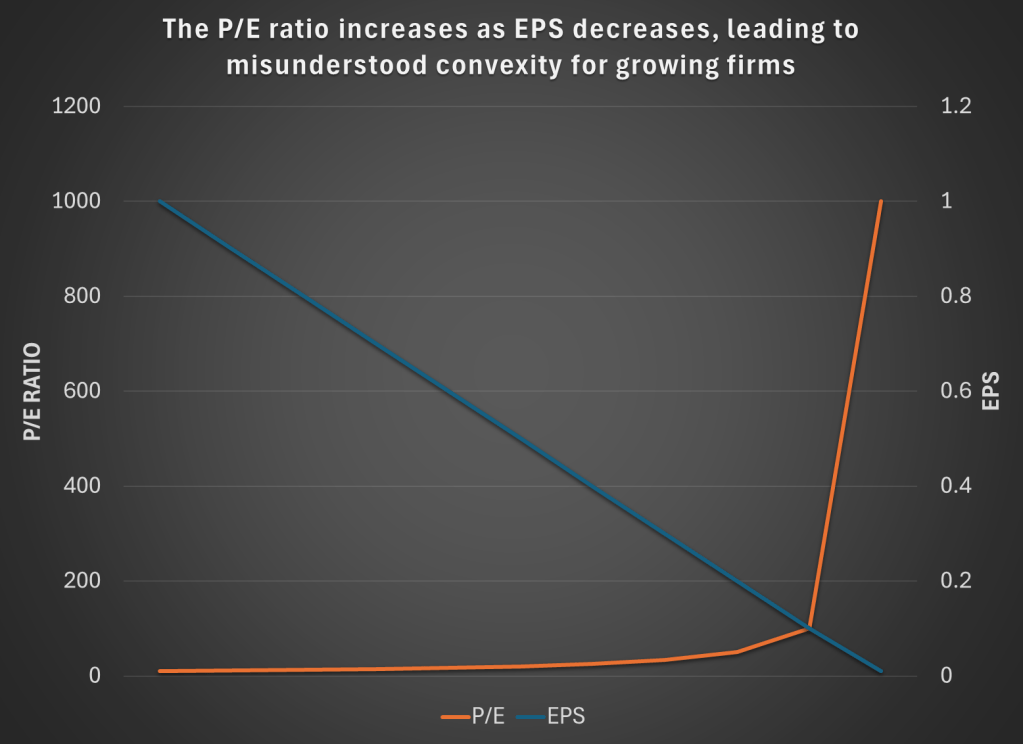

(A quick tangent: P/E ratio is not a great measure of a company’s value or potential return to shareholders. It’s subject to increased convexity as the EPS approaches zero (i.e., a company could have a 10 ratio if they make $1.00/share, or they could have a 1000 P/E ratio at $0.01/EPS a share). As a result, as firms move from losses into profitability, you see massive P/E ratios that defy logic. P/E ratios are mostly relevant for stable firms with reasonable market growth.)

And somehow, despite all intuitive reason, Nvidia has shifted from a mature firm to a growth firm.

I don’t think I need to stress how unlikely it is for a company to move from maturity to growth, but the AI revolution truly is a revolution. When social media truly began to show its wings, companies started dipping their toes into investing in social media integration. The issues they faced were understanding adoption (it seemed like everyone had an “app” even if the apps did nothing). But the key point was that despite not truly knowing how to use the information, the firms continued to invest in social media in hopes that they would find the treasure along the way. Over a decade later, there’s no doubt that we’ve seen the direct fruits of those labors.

I make a similar case for Nvidia that can be defined as such: AI spending will only continue to increase while companies throw spaghetti at the wall to see what sticks. Nvidia simply cannot be making its increased revenues in 2024 based on a higher volume of units sold. TSMC simply does not have the production scalability to drive it; most of TSMC’s additional production and fabs will not come online until the second half of this decade. In addition, Nvidia cannot book future sales as revenue until the product is delivered, so a natural conclusion to these factors is that Nvidia is exercising pricing power. And why shouldn’t it?

In a gold rush, you want to be the guy selling the shovels. In 2022 and through most of 2023, Nvidia could be defined as a maturing business with solid growth. Its performance was very good until the crypto-mining boom dried up with Ethereum’s shift, leaving most of its revenue coming from the datacenter and consumer gaming division. It’s not a stretch to say by that point its growth had become defined and was in the maturity stage.

I can’t think of any other firm in my memory that had gone from clear growth (gaming’s rise) to maturity (console domination with Xbox 360 and PS3) to growth (crypto-mining’s rise) to maturity (crypto goes through proof of stake) to growth again (AI). Nvidia continues to rake in the cash and has incredible growth again. And it’s kind of incredible because Nvidia’s volatility in growth was never really related to macroeconomic trends.

The Easy Arguments Against the AI Revolution (and their validity nuanced with expected growth probabilities)

- AI is a temporary thing.

- AI will take all the jobs.

- It’s not sustainable because it’s already grown so much.

AI may be a temporary thing, but it’s almost certainly not. The internet changed everything, social media changed everything again, and the crypto evangelists thought their Ethereum would (still hasn’t), but now we’re seeing that potentially AI can change everything again. A key component of the internet and social media’s influence on the world is that it took years to begin seeing the true potential. AI has the same limitation.

The whole idea of something growing so quickly that it must be a bubble is a poor argument, even if it tends to be mostly accurate. I’ve spoken to several people in the last few weeks about this very concept: “the dot-com era was a bubble, so this AI revolution is currently a bubble.” To which the answer is “yes and no.” The dot-com boom was predicated on companies using the internet, and as a result, they would have massive growth. The rising equity values of worthless companies were absolutely a bubble, and I’d be a fool to imply anything otherwise. Relative to their ballooning equity valuations, most firms of the dot-com bubble did not have rising revenues or rising profits.

Thus by this metric, the AI revolution may show signs of a bubble. Certainly, C3.ai and Palantir aren’t materially different businesses than they were 18 months ago (they can be, but aren’t yet). But don’t lump Nvidia into that category. It’s in the business of selling the hardware for datacenters. Its business is materially different than it was 12 months ago. It is this magical unicorn-bred-with-a-mermaid that has both rapidly rising revenues and profits.

So what’s it worth? It’s so hard to say, but the answer is that it’s probably worth more than what it’s trading for now.

Leave a comment